Compound interest: it's the silent force that builds wealth, turning small savings into substantial sums over time. Understanding it is key to securing your financial future. This guide will show you, step-by-step, how to harness the power of compound interest, from the basics to more advanced strategies.

Understanding the Basics: The Snowball Effect

Compound interest isn't magic; it's the interest earned on your initial investment plus the accumulated interest. Unlike simple interest (where you only earn interest on the original amount), compound interest grows exponentially. The longer your money's invested, the faster it grows. Think of it like a snowball rolling downhill – it starts small but gets larger and larger.

The Formula: Unlocking the Power of Compounding

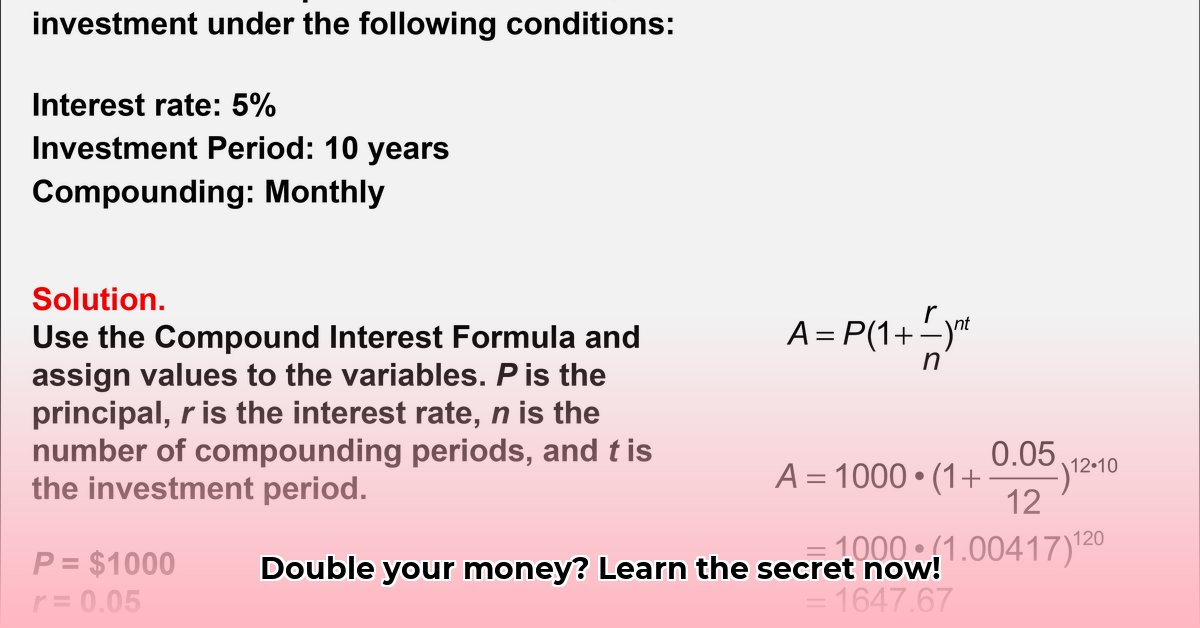

The formula for compound interest is:

A = P (1 + r/n)^(nt)

Where:

- A: The final amount (principal + accumulated interest).

- P: The principal (your initial investment).

- r: The annual interest rate (as a decimal; e.g., 5% = 0.05).

- n: The number of times interest is compounded per year (annually = 1, semi-annually = 2, quarterly = 4, monthly = 12, daily = 365).

- t: The number of years the money is invested.

Did you know? The more frequently your interest compounds (daily vs. annually), the faster your money grows. This is why high-frequency compounding is so beneficial for long-term growth.

Step-by-Step Calculation Guide

Let's calculate the compound interest on a $1,000 investment at 6% annual interest, compounded annually for 10 years.

- Identify your variables: P = $1000, r = 0.06, n = 1, t = 10.

- Plug into the formula: A = 1000 (1 + 0.06/1)^(1*10).

- Calculate: A = 1000 (1.06)^10 ≈ $1790.85.

After 10 years, your investment grows to approximately $1790.85.

The Impact of Compounding Frequency: Maximize Your Returns

Let's recalculate our example with monthly compounding (n=12):

A = 1000 (1 + 0.06/12)^(12*10) ≈ $1819.40

Notice the difference? Monthly compounding yields a significantly higher return than annual compounding. This illustrates the power of more frequent compounding.

Utilizing Online Compound Interest Calculators

Manually calculating compound interest can be tedious. Fortunately, many free online calculators are available. These tools simplify the process by letting you input your variables and instantly see the results. Experiment with different scenarios to understand the impact of changing interest rates, time horizons, and compounding frequencies. This allows you to easily explore different investment strategies and their potential outcomes.

Practical Applications and Strategies

Compound interest applies to various investment vehicles:

- Savings Accounts: Offer low but secure returns.

- Bonds: Relatively low-risk investments providing fixed income.

- Stocks: Higher potential returns but also higher risk.

- Mutual Funds: Diversified portfolios spreading risk across multiple investments.

Important Note: Inflation erodes the purchasing power of money. A 6% return doesn't fully represent your gain if inflation is 2%; your real return is closer to 4%. Always factor inflation into your investment projections.

Advanced Concepts (Optional)

- Tax Implications: Investment returns are often taxed, so understanding tax implications is crucial for accurate financial planning.

- Inflation-Adjusted Returns: Calculate real returns to account for inflation's eroding effect.

- The Rule of 72: A quick way to estimate how long it takes for your investment to double (divide 72 by the interest rate). For example, at 6%, it takes roughly 12 years (72/6 = 12).

Conclusion: Start Your Compound Interest Journey Today

Understanding compound interest is vital for long-term financial success. Start investing early, contribute regularly, diversify your portfolio, and consider seeking professional advice. By consistently leveraging the power of compound interest, you can significantly improve your financial standing over time. Remember, your financial future is an investment in you.